My 2021 financial goals aren’t really complicated. I only have a few main things I’d like to focus on as far as paying off and saving up for.

DEBT

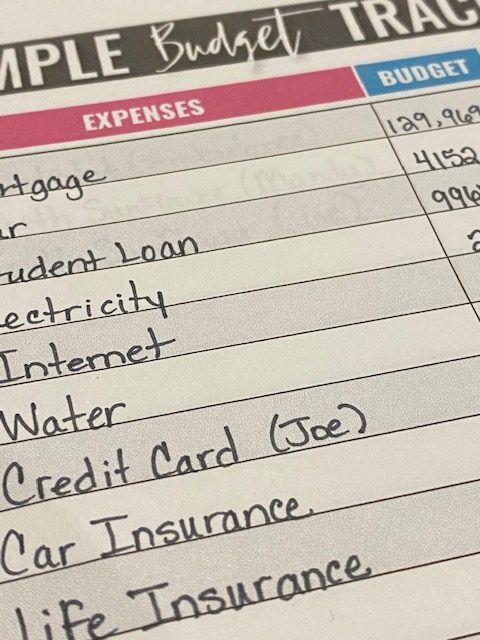

This is what I’ll be working towards to pay off or pay down. These are not our only expenses or debt by any means, but it’s the few I have really set my intentions on accomplishing this year:

Car– We owe $4152 on the car. I want this paid off this year. We are so close! We are scheduled to have this paid off around December of this year but I’d like to hit that goal sooner. Not having a car payment will free up $320 extra a month that can be rolled into other bills, like…

Student Loan– I owe $9965 on my student loan. I call this the “stupidity tax” that I pay each month. I don’t know that I could get this paid off in a year’s time, but I definitely plan to throw extra money at it each month to help. Why do I call this stupidity tax? It’s not that I don’t use my degree…I most certainly do and I had to have a degree to have the job I have. However, I was very undecided when I started college many years ago and I never should have taken out loans only to drop classes some years, etc. A community college for the first 2 years (which I could have attended for next to nothing) would have been the wiser choice until I was certain about what I really wanted.

Credit Card– My husband has a credit card with a balance of $3500. We want this debt eliminated in full this year.

Medical Bills– Our medical bills are still being tallied. We have insurance plans with high deductibles and I have had to have some expensive testing done towards the end of 2020. I just accept these bills as a fact of life. I am a heart patient and I will always have to see my cardiologist and have expensive tests run. The end. However, paying them down or off as fast as we can is always the goal.

SAVINGS

My husband and I joke that Murphy loves to visit us when it comes to saving money. You know Murphy’s Law….If something can go wrong, it will. And boy does it, every time we try to save money! Something always happens. However, I’m always thankful when those things happen that we have money saved back for it. The plan for this year is to save, save, save! Hubby has separate savings account at work, but we also have our personal savings and that definitely needs to be beefed up.

SPENDING

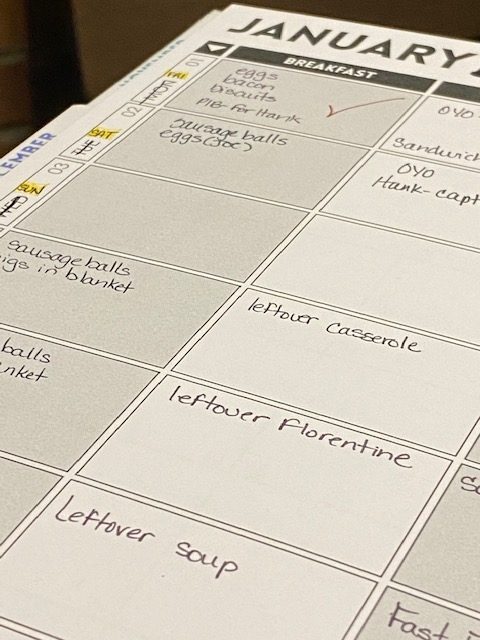

purple trail meal planner

Our biggest expense is our grocery bill. I took an inventory of our pantry on New Year’s Day and came to the conclusion that there is absolutely NO need for our grocery bill to be so astronomical when we have so much food here already. I finally sat down with my meal planner and came up with a game plan for meals this week. We made a shopping trip and kept our grocery bill under $100 for this week. I was pleased with that. Normally, it’s over $200. This is an area that we definitely can improve upon. It just takes some effort on our part…planning and cooking.

So, these are our major financial goals for 2021. We have a whole year ahead of us to hopefully eliminate or seriously pay down some of this debt.

Leave a Reply