I participated in a campaign on behalf of Mom Central Consulting for Aflac. I received a promotional item as a thank you for participating

Unexpected medical costs can really cause your personal finances to take a hit. It’s one of the biggest debts our family has. My husband and I both have medical problems that require regular blood tests, doctor visits, and prescriptions. We both have insurance, but insurance doesn’t cover everything and it often takes us the entire year to meet our high deductible, only to have to start all over again. Sound familiar?

Last summer our son became sick in the middle of the night. We were really worried about him, so we went to our local emergency room to get him looked at by a doctor. He turned out to be ok, but their were x-rays, blood tests, and the cost of seeing the doctor. That trip ended up costing us $1,200 out-of-pocket even after insurance paid. It was definitely unexpected and we’re still paying on this bill.

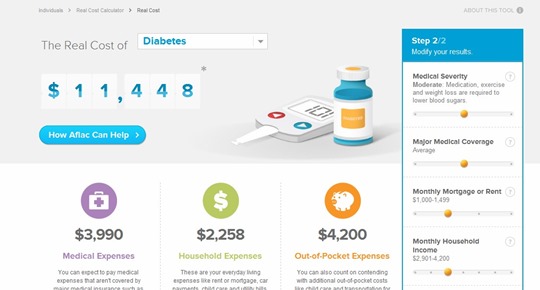

Aflac has a handy tool called the Real Cost Calculator that you can use to calculate different medical emergency and illness scenarios as they would apply to you to see what your out-of-pocket costs may be if were to happen to you or a family member. It also shows how Aflac can help fill in those gaps of your regular insurance coverage.

Because I have Type 2 diabetes, I used the Real Cost Calculator to see what my out of pocket costs were really adding up to be. I was shocked to find that it can cost up to over $11,000 a year. The $4,200 out-of-pocket expenses proved to be about right in my situation. Add in the fact that my husband also has the same thing, and we are looking at over $8,000 a year. It’s certainly sobering to see that amount. Factor in if this were to cause one of use to miss work, and the loss of income could be detrimental to our family.

Are you prepared for sudden, unexpected medical expenses? Try the Real Cost Calculator for yourself and see how these scenarios could affect your family and how Aflac can help.

This sounds like a very useful tool. It can come in handy for those who have flexible spending accounts available at work.